Announcement : New courses and workshops

Genesis Information Hub for partner for business training workshop short courses

Conferences In-house Training and work related seminars

If you are looking for well researched relevant and cutting edge skills development programmes you have come to the right place

|

+27 72 984 1927

|

info@gihub.co.za

|

Durban, South Africa

|

|

Browse Our Courses Below

then simply get in touch with us to start

reaching your business goals!

|

CYBERCRIME INVESTIGATION & RISK MANAGEMENT

OVERVIEW

Crimes such as theft, fraud, money laundering, identity theft, corruption and a variety of corporate and white collar crimes are all committed using computers the internet and related technologies

Organisations in the public and private sector and their staff and personnel are now

at risk more than ever. The risks to an organisation are both internal and external. The workshop will provide delegates with insight and knowledge of the legal aspects of cybercrime, the investigation of Cybercrime and the risk management of cyber and electronic crime. The focus of the course is on the practical issues that specifically relate to cybercrime and the investigation thereof. Delegates will therefore be provided with the knowledge to confidently investigate cybercrime and the knowhow on how to mitigate risks associated with online and computer technology related risks.

|

|

ASSET LIFECYCLE MANAGEMANT & LIFECYCLE COSTING

OVERVIEW

Asset lifecycle management describes the best practices regarding lifecycle decisions about assets. It explains how to develop lifecycle plans for critical assets in terms of their expected economic life, mid-life overhaul plan, maintenance approach, suitability of the technology and lifecycle costs.

This process aims to realize and optimize the value of assets and assists asset managers in making repair/replace decisions.The recent release of the ISO 55000 series on Asset Management Systems provides an effective mechanism to support asset life management. This course is designed to bring all these elements together to demonstrate the practical applications of asset management plans, equipment productivity, life cycle and life cycle cost management with reference to relevant case studies to reflect on these key issues and its application to new and ageing assets

|

|

MV/HV/LV OVERHEAD LINES CONSTRUCTION, INSPECTION & MAINTENANCE COURSE

OVERVIEW

Electricity Transmission and Distribution Utilities increasingly come under pressure to enhance electricity supply availability and reliability. Customer expectations are on the increase, while the Regulator is tightening up on compliance. Furthermore, there are specific legal and regulatory requirements that must be adhered to. Utilities on the other hand are also confronted by cost increases while they must remain sustainable.

Considering the asset base under control of the various utilities, overhead lines account for a substantial component of the asset base to be operated and maintained. The course deals with low voltage, medium voltage, high voltage and extra high voltage overhead lines. The course is designed to cater for a diverse audience. The course structure allows for interaction and engagement on topics which might be of benefit to the study group. While the course is not structured to challenge organisation specific practices and standards, the course is designed to provide an objective reference point

|

|

TALENT MANAGEMENT – PLANNING, ACQUISITION,

RETENTION & ANALYSIS

OVERVIEW

Successful managers and team leaders need the skills to plan, find and recruit, retain and analyse the best candidates for their team. This training programme involves participants working on processes and procedures that result in successful recruitment and selection and retention decisions through the use of group and individual activities, exercises, formal inputs etc.

By attending this training programme, learners will be able to understand how human resource planning logically flows from strategic planning, as well as how it links to skills development and related strategies.

|

|

GENERAL DATA PROTECTION REGULATION

OVERVIEW

The GDPR demands compliance by default. IT systems utilised by companies to process PI must automatically gather such information in compliance with the GDPR. It must be a process by default. Technical and organisational measures must automatically assure the legal processing of personal information. This means that at the point of PI data inflow (the point at which PI is first gathered) the data gathering has to be in compliance with the GDPR in accordance to the technical and organisational demands of the act. The gathered PI then has to be further processed through:

“ …, technical and organisational measures” that “must be implemented to ensure only personal data necessary for each specific purpose of the processing are processed, including the amount of personal data collected, the extent of their processing, the period of their storage and their accessibility.” Article 25 Data protection by design and by default.” The training will empower companies to develop an integrated IT compliancy solution that will incorporate technical and organisational measures that by default will make them GDPR compliance. A Global perspective will be added to incorporate APAC region compliancy with regards to GDPR compliancy and its countries local PI legislation. Implementable solutions and the feasibility thereof will be the theme of the training. Solutions and not obstacles is what the course is about. The myth of the “impossible to comply” will be dispersed with. Existing IT systems and company policies of the representatives will be discussed and how those systems can be utilised and adapted to become GDPR compliant. It is problem solving and not risk taking that will be emphasised. Therefore, attendees with both advanced and basic knowledge of the GDPR will benefit.

|

|

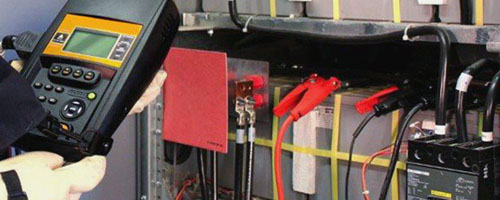

UNINTERRUPTABLE POWER SUPPLY SYSTEMS

OVERVIEW

Uninterruptable Power Supply systems (UPS) form an integral part for most of the applications that require a stable and reliable power supply. Loss of electrical power to critical equipment may lead to equipment damage, extensive repairs and/or unnecessary disconnection (shutdown) of vital equipment such as: computers, servers, process control equipment, etc.

Indirectly this could lead to production losses and loss of revenue. Power outages should not be our only concerns, management and electrical engineers should also be nervous about the quality of the power supply (the presence of surges/spikes, dips, harmonics, etc.) when it comes to supplying power to critical applications. For this workshop the participants require a working knowledge of basic electrical engineering principles. Essential aspects of the key power electronic components to be found in UPS systems will be revised at the beginning of the workshop. This two day technical workshop kicks off with a discussion on the need for UPS systems; we’ll refresh our memories on power electronic components and the conversion of electrical energy from DC to AC, after which we’ll compare the different UPS topologies and their modes of operation, continuing with typical applications.

We’ll discuss the main components found within a typical UPS and how AC is converted into DC and then inverted back to AC.

|

|

LIGHTNING PROTECTION & EARTHING OF

ELECTRICAL POWER SYSTEMS

OVERVIEW

This seminar guides the delegates through the important aspects of power system earthing. Poor earthing practices and incorrect installations may cause continuous and intermittent difficult-to-identify problems in your power system, often leading to production losses and premature equipment failure. Even worst protection equipment (on which we rely to save lives and protect electrical apparatus) may fail to operate/protect as a result of inadequate earthing.

Emphasis is placed on the different aspects of system earthing as well as the different types of earth electrodes and their efficiency. We’ll discuss the earthing principles of some of the electrical equipment found in a typical electrical system.During this seminar we’ll follow a practical step-by-step procedure on how to design substation earth mats, supported by the essential calculations. In addition we’ll look at the latest acceptable methods for joining copper terminals and strips. We’ll deal with the concepts of lightning and surge protection and discuss the lightning phenomena. You’ll learn how to protect buildings and structures against the effects of lightning.

|

|

|

|

|

WE ALSO OFFER A VARIETY OF LEGAL,

OCCUPATIONAL HEALTH & SAFETY,INDUSTRIAL AND

LABOUR RELATIONS TRAINING

|

|

|

|

Some of the courses on offer include:

Health and Safety Representative Course

The OHS Act and the Responsibilities of Management

Managing Day to Day Issues/ Problem Employees

Full day workshop

Workshop Chairing Disciplinary Hearings

Compensation for Occupational Injuries and Diseases Course

Workplace Discipline and Dismissal

Employment Equity Committee Training

Shop Steward Training

Basic Labour Relations

|

| Back | Back to top |